Good afternoon,

I hope you had a wonderful holiday weekend! This month we’re still seeing the normal summertime lull for steel, experiencing another shakeup in the non-ferrous markets. Market sentiment overall remains cautious. The evolving landscape of global tariffs and potential trade negotiations is casting uncertainty over long-term planning and making it increasingly difficult for some manufacturers to conduct business with confidence.

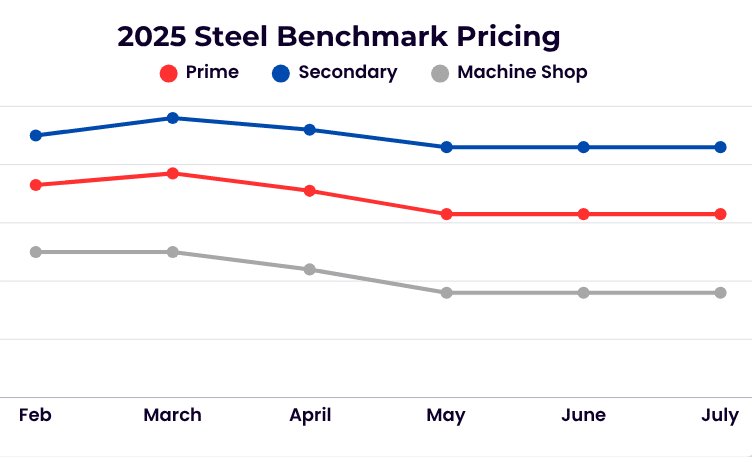

Steel:

The steel market moved sideways again for the third consecutive month. Last year at this time we were gearing up for seven consecutive months of repeat pricing before the market showed signs of life this past January. Domestic and international weak markets along with ample scrap availability ultimately prevented upward movements in prices this month that some recyclers were initially expecting.

Non-ferrous:

Chinese buyers continue to show little interest in US copper scrap due to their ongoing sluggish economy and struggling real estate market. Combined with the wide arbitrage between the Chicago Mercantile Exchange and the London Metal Exchange, domestic consumers are still pricing and historically high copper spreads. President Trump’s July 9 tariff negotiation deadline has been contributing to a bearish market. Argus Metals states that “He began delivering letters on Monday to countries that detail their new ‘reciprocal’ tariff rates if trade negotiations fail to yield an agreement.” However, the recent 50% copper tariff announcement has sent Comex copper running up, while the LME copper declines.

Aluminum rolling mills continue to lower their buying prices with weaker demand. The soft interest for used beverage cans (UBC) is coupled with some mills quoting for September delivery. We’re also seeing a larger decrease in the smelter grade aluminum scrap that is associated with the domestic decrease in the automobile industry.

Stainless and Alloy:

The 30-day LME Nickel average has remained relatively steady to slightly down, showing resilience compared to other commodity markets that have been more visibly impacted by newly imposed tariffs. Stainless grades 304 and 316 continue to hold firm, buoyed by recent declines in scrap flow. However, 316 may experience upward pricing pressure as supply tightens in Molybdenum concentrates. Chrome stainless grades remain stable for the time being, perhaps benefiting from the broader steel market’s sideways movement.

High-temperature alloys have seen a modest decline, reflecting the subtle downward trend in their underlying input markets. Encouragingly, demand has proven more robust than expected heading into July, providing some support against further erosion in value.

In contrast, Titanium grades continue to soften, particularly select prime material, as labor tensions escalate in Europe. A pending strike vote by members of the European Unite union—spurred by disputes over inadequate pay—could lead to production delays and disrupt Airbus delivery schedules, casting a shadow over an already fragile sector.

Tool steels, high-speed steels, and Tungsten alloys are poised for potential price increases, with recent import duties reducing the availability of these goods in the U.S. market.