As we approach Year-End, we are reminded that our continued success would not be possible without our strong partnerships. Thank you for your commitment to our recycling programs—we look forward to entering 2026 with great possibilities. Now, for our final update of the year!

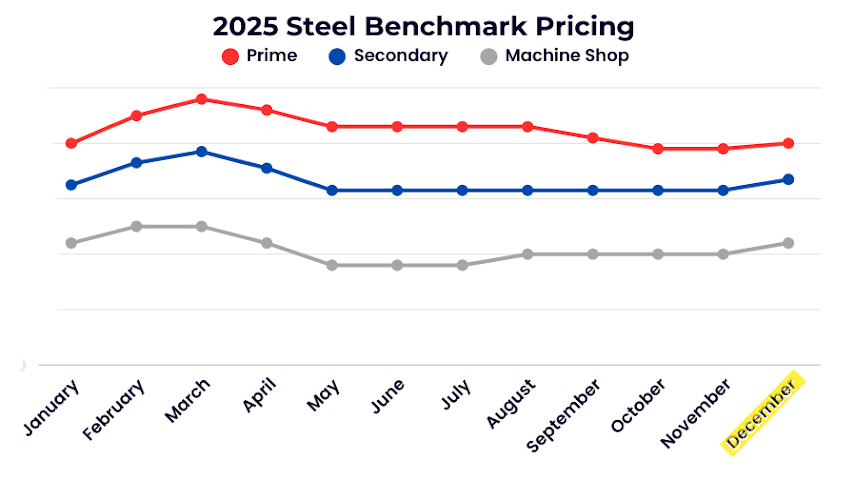

Steel

After several quieter months, the steel market saw pricing increase across the board to close out the year. Prime scrap rose modestly, while cut grades experienced stronger gains. Although weekly U.S. steel output has remained flat, seasonally slower inbound scrap flows and holiday disruptions tightened supply. What was expected to be a calm month shifted when a southern mill increased pricing to secure material for December, adding upward pressure across the market.

Non-Ferrous

Aluminum:

The aluminum MWTP remains historically high, but weak demand continues to limit scrap price increases. Fire-related outages at Novelis’ rolling mill in Oswego, New York have contributed to an oversupply of aluminum, enabling other mills to purchase material at discounted rates.

Copper:

Copper prices rose to record highs on the LME this week, while the Comex declined sharply ahead of the Federal Reserve’s interest rate decision. Concerns of an impending copper shortage in the export market are pushing LME pricing upward.

Stainless and Alloy

LME Nickel has traded within a tight range over the past month, yet stainless markets remain subdued due to persistently weak mill demand heading into the end of 2025. Grades 304 and 316 have seen modest pullbacks, with additional softening possible in 316 if Molybdenum continues to decline. While a few January inquiries have begun to surface, industry sentiment remains cautious, with limited signs of near-term recovery.

In contrast, chrome-bearing stainless grades are showing relative stability, supported by firmer steel pricing this month.

High-temperature alloys may also see price reductions, influenced by lower Molybdenum values and seasonally soft demand. Although Cobalt continues its upward rally, alloy markets have yet to gain momentum as the year concludes.

Titanium markets remain muted, with sentiment still negative heading into 2026. In related news, two of the world’s largest aircraft manufacturers are finalizing a consolidation deal following a challenging year for one of the companies.

Tool Steels and High-Speed Steels continue to trend flat. Tungsten Alloys, however, have been setting record highs in recent months. While supply currently exceeds demand, pricing is still expected to strengthen in the near term. Even so, market participants remain cautious, aware that pricing could pivot quickly should sentiment shift.