Good Morning,

Currently we’re seeing many manufactures as well as most mills and foundries enter the holiday season cautiously. US companies announced the largest job cuts (over 150,000) which is the highest for any October in over two decades.

Steel:

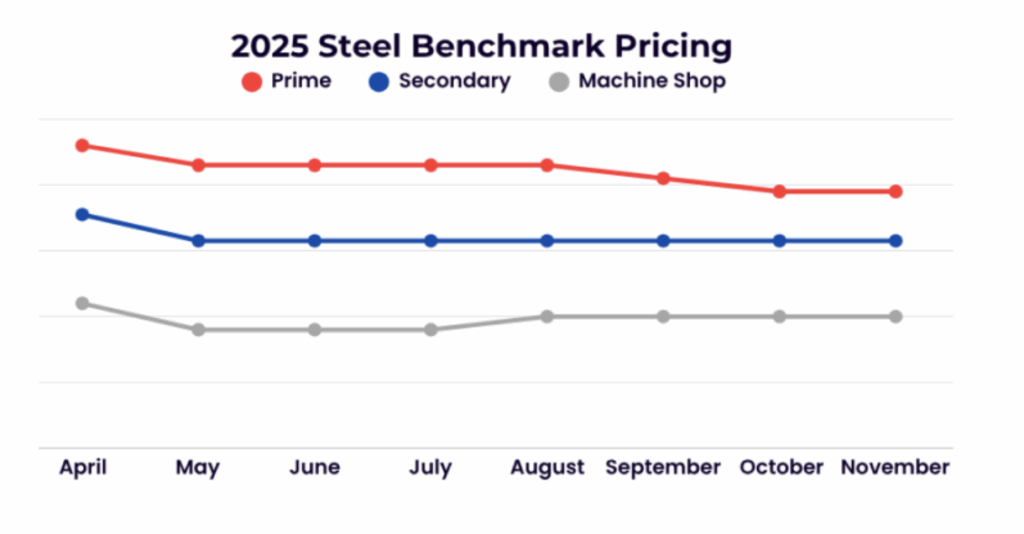

As expected the steel market went sideways on all grades. Consumers are currently trying to pressure buy prices downward, citing sluggish demand for finished steel and disruptions to construction activity caused by typhoons and flooding in Asia. However, some US consumers have noted a modest improvement in demand for some secondary markets.

Non-ferrous:

As the aluminum MWTP continue increase to new highs, some fabricators have switch to alternative material, such as magnesium, to decrease costs. Argus published that “purchases from aluminum producers are expected to slow in November because prices remain high and the industry has entered its off-season.” However, some manufacturers are expecting aluminum to continue to replace copper in some automotive and household appliance applications given the high copper prices.

The slowing global economy, particularly in China, has limited copper demand. China’s weak residential construction sector has been the key factor for the drop in demand, and their current number one priority is now artificial intelligence. As a result, copper spreads continue to widen based off the Chicago Mercantil Exchange with subdued trading expected during the holiday season.

Stainless and Alloy:

30-day LME Nickel has remained relatively stable, trending slightly below its recent average. However, stainless demand is expected to remain subdued through the remainder of 2025 due to typical year-end seasonality. 300-series, 316, and Chrome stainless grades have all recorded declines compared with the prior month. Adding to the uncertainty, ongoing economic headwinds have delayed U.S. mill contract negotiations—traditionally concluded in October—which are now anticipated to settle in November or December. Despite these challenges, the U.S. market continues to outperform Europe, supported by trade measures introduced in the second quarter that successfully curtailed inflows of low-priced imports.

High-temperature alloys segment, sentiment mirrors that of Nickel, with prices maintaining firm support amid year-end positioning. Select grades such as Inconel 625 and 718 are holding comparatively well, while less-utilized grades have softened. Cobalt continues to show a modest strength pattern, whereas Molybdenum remains under downward pressure, as previously highlighted in last month’s update.

Titanium market continues to face significant headwinds. Production delays from a major aerospace manufacturer—whose new aircraft program is now postponed until 2027—have dampened demand. Lower-grade Ferro Titanium has been particularly affected, with two of Europe’s largest mills recently declaring bankruptcy. Compounding this pressure is the declining use of Ferro Ti in automotive and steel applications, as automakers increasingly substitute aluminum for vehicle bodies and truck beds. Furthermore, the influx of cheaper Russian-origin Titanium units, often rebranded through third countries or blended into U.S. lots, is distorting market pricing. Mills broadly expect 2026 to mirror current conditions, with a tentative recovery not projected until Q4 2027.

In contrast, Tool Steel markets are showing resilience, with select grades containing Tungsten exhibiting strength. Tungsten-based alloys continue their upward trajectory, albeit at a slower pace, driven by tightening U.S. supply as export volumes remain elevated.

Overall, the alloy market remains in a state of cautious limbo. Year-end inventory management, economic uncertainty, and the pending outcome of tariff and trade policy decisions have left many manufacturers hesitant to commit fully to their procurement strategies heading into 2026.