I hope all is well there! We’re seeing some market stability heading into September. However Q4 sentiment has cooled, with recovery expectations pushed into early 2026. Consumers and mills are anticipated to re-enter the market with renewed appetite. However, lingering uncertainty around tariffs poses a potential drag on both demand forecasts and anticipated delivery schedules.

Steel:

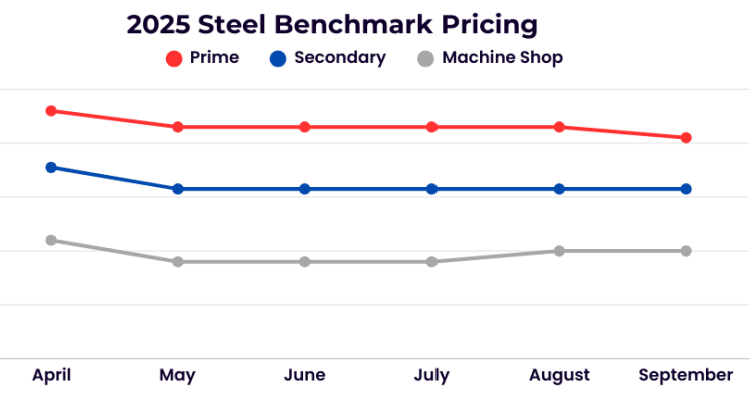

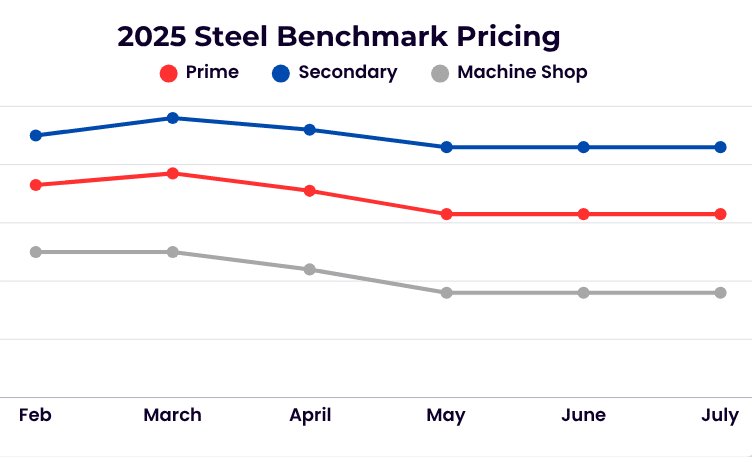

Breaking last years trend of sideways movement to the end of the year, prime scrap dropped after standing still for 4 months. Reduced prices for mill sales along with an abundance of prime scrap available led to this months drop. Cut grades went remained the same and are expected to continue the trend in October. However, there’s anticipation of some life going into the final 2 months.

Non-ferrous:

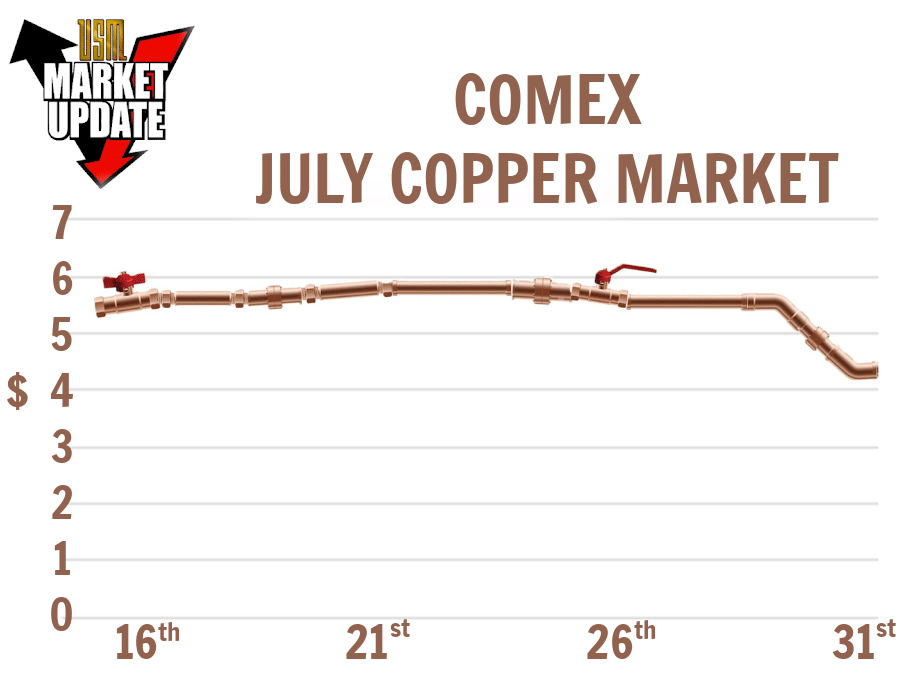

US president Donald Trump has stated he will lower tariffs on EU-manufactured cars and auto parts to 15% as part of a trade agreement with the European bloc, but the effective date has yet to be determined. The copper arbitrage between the LME and Comex has remained close during the past month leading to improved copper spreads. Future copper consumption for increased US data centers to support AI will help keep prices stable and at some point, increase well as continued construction is maintained and grows.

The aluminum market has been relatively quiet internationally with the US Midwest aluminum premium maintaining its historic high. Consumers normally start to discuss next year’s orders over the next month. Due to future uncertainty, negotiations are currently being delayed until there is clarity regarding global tariffs, which will result in a longer review period.

Stainless and Alloy:

LME Nickel has remained confined within a narrow trading band over the past month. Stainless grades 304 and 316 are holding firm but could experience modest downward pressure in October as mill orders soften. Chrome stainless grades appear comparatively stable for the moment, though that stability may shift as additional mill guidance emerges.

High-temperature alloys continue to exhibit weakness, with consumers and mills alike deferring deliveries. Ample supply remains in the market, adding further weight to prices. Last month’s optimism surrounding a Q4 aerospace rebound has since diminished, with analysts now pushing expectations of renewed strength into Q1 2026.

Titanium markets remain unsettled, with abundant supply driving continued price volatility. The aerospace and aviation sectors have delayed activity, while steady scrap flow sustains downward pricing momentum. Since reductions began in April 2025, certain titanium grades have fallen nearly 15% from their 12-month highs. A meaningful recovery may prove a longer journey, with a rebound not anticipated until closer to the end of Q2 2026.

Tool steel values remain largely stagnant, though tungsten carbide pricing shows encouraging signs of improvement. China continues to absorb much of the scrap produced but has been slow to reintroduce units into the global market—a key factor supporting elevated values.