Good Morning,

As we enter the 4th quarter, we’re reminded that Q4 has been a period of limited growth and lighter trading activity. This year, the uncertainty surrounding potential new tariffs and import duties makes forecasting even more challenging. Until clearer trade terms are established, manufacturing sectors are likely to remain cautious, limiting material intake as they prepare to enter 2026 with restrained confidence and measured inventory positions.

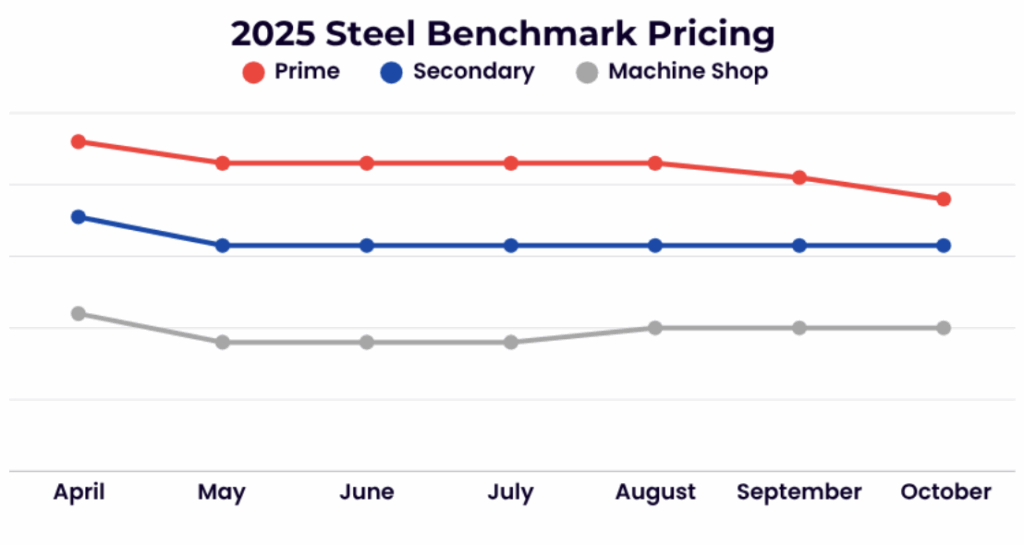

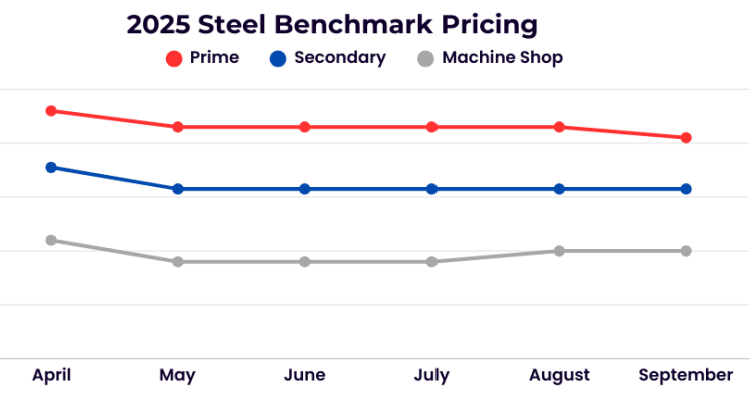

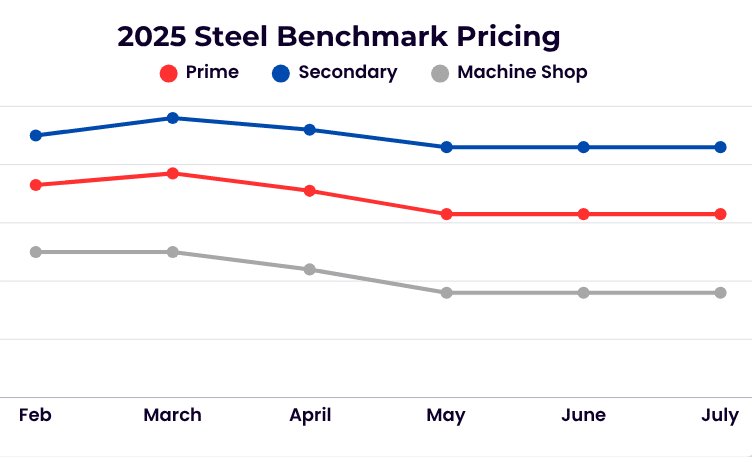

Steel:

The steel market softened slightly this month, with prime, cut grades and shred grades declining $10-$20/GT. Demand remains sluggish in key sectors like construction and automotive, while global overcapacity—especially from new production in Asia—continues to weigh on prices. Trade policies and tariffs are also shaping the landscape, with both the U.S. and EU maintaining protectionist measures. Input costs for materials like iron ore and energy remain volatile, squeezing margins for producers. Analysts expect steel prices to stay relatively steady through the end of 2025, with potential for a gradual rebound in 2026 as demand slowly recovers.

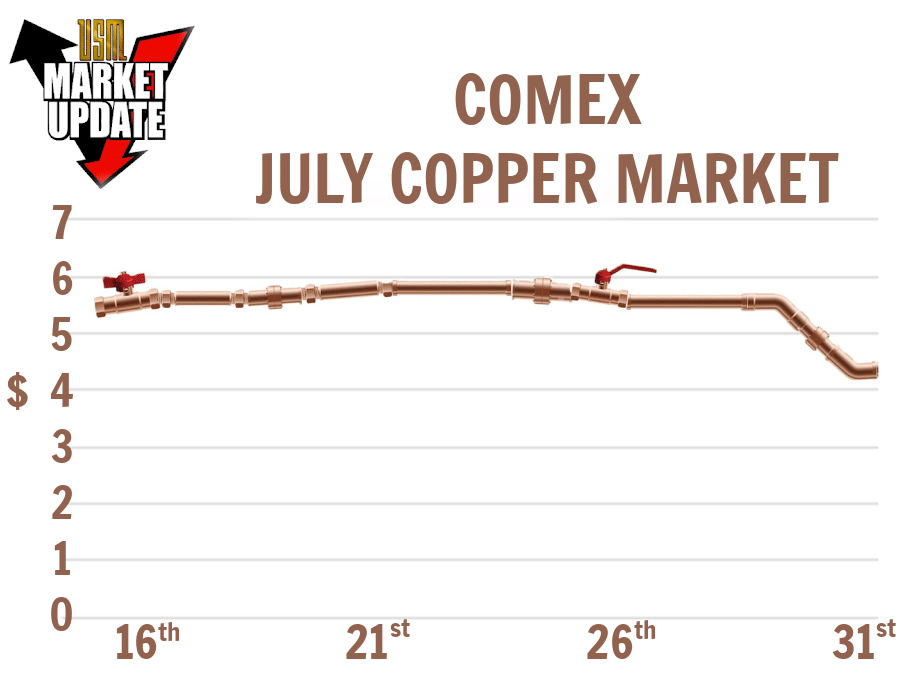

Non-ferrous:

The growing arbitrage between the London Metal Exchange (LME) and Comex copper markets is once again causing wider copper scrap discounts in domestic and export markets, primarily driven by policy changes. This was previously observed in July 2025, following a tariff announcement that created historical spreads before being partially walked back.

Even as the LME and Midwest premiums hit record highs, the story on the ground feels a bit different. With inventories still running high and supply readily available, scrap prices have remained relatively steady—showing only minimal movement despite the broader market surge. Recent supply disruptions—most notably the major fire at a Novelis plant in September 2025—have further tightened parts of the market. At the same time, fewer aluminum outlets are only adding to the oversupply challenge, making an already complex situation even more difficult to navigate

Stainless and Alloy:

The LME has been trading within a notably tight range over the past month; however, weak mill demand continues to exert downward pressure on stainless grades. Compounding this softness, one of the major mills has temporarily halted operations for a three-week maintenance period. Grade 304 has experienced a more pronounced price reduction, with 316 following suit—partly due to the continued decline in Molybdenum values. Additionally, Q4 activity is subdued as many users seek to close out the year lean, avoiding excess inventory buildup.

High-temperature alloys are also trending weaker as demand continues to wane through the remainder of 2025. Mills are signaling reduced order volumes, reinforcing an overall cautious sentiment. While Cobalt prices are showing renewed strength, Molybdenum remains under pressure, and market participants have largely retreated to the sidelines. Cobalt’s gains may take additional time to translate into broader value improvements given the sustained softness in demand and prolonged floor-level trading. A slower-than-expected recovery in aircraft production has also constrained price movement across this segment.

Titanium markets remain unsettled, burdened by oversupply and postponed demand from aerospace and defense sectors. Although medium-term demand growth is anticipated, current production continues to outpace consumption. In anticipation of this slowdown, the world’s largest titanium sponge producer reduced output during Q3. At the same time, ongoing challenges related to tariffs and import duties have increased costs by as much as 60% in certain cases, significantly eroding profit margins.

Tool steel values remain relatively steady, while high-speed steels may find modest support from firmer Cobalt prices. Nevertheless, a more substantial rebound in manufacturing activity will be needed to sustain any meaningful upside. Tungsten carbide values, which had seen notable increases earlier in the year, appear to be stalling as Chinese market support has softened for two consecutive weeks.